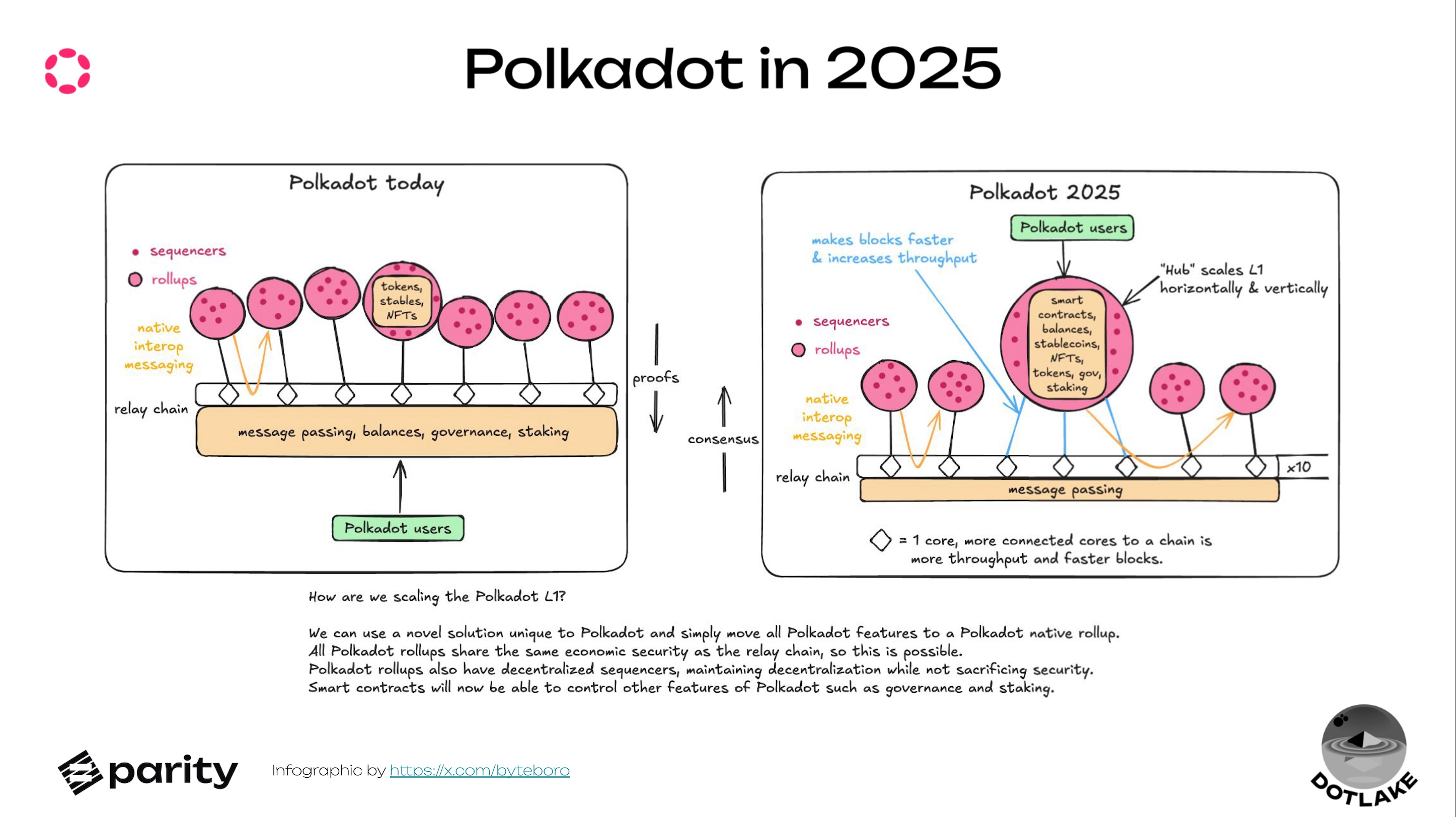

The recently unveiled Polkadot 2025 Roadmap by the @paritytech team represents a significant step forward in the evolution of the Polkadot ecosystem. With Polkadot 1.0 laying the foundation for scalable Layer 1 solutions, native interoperability, and shared security, Polkadot 2.0 aims to elevate these innovations further. The focus is on adapting the network for diverse use cases while unlocking powerful tools for developers and users.

Among the standout updates, the support for Solidity smart contracts on Asset Hub is particularly noteworthy, as it brings Ethereum compatibility directly to Polkadot, potentially reshaping the utility of its native DOT token.

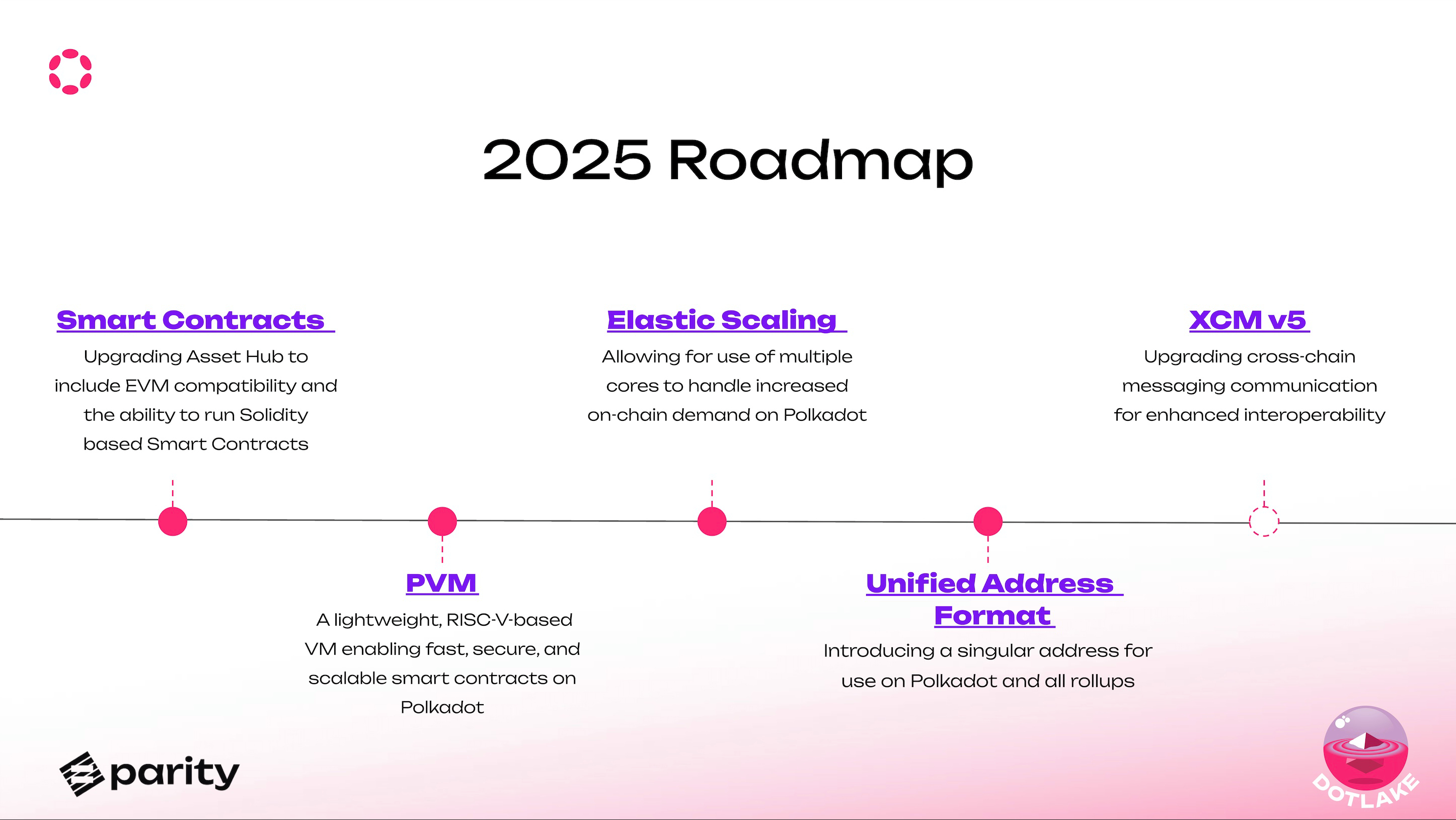

One of the most exciting features in the roadmap is the upcoming upgrade to the Asset Hub, which will introduce full EVM (Ethereum Virtual Machine) compatibility. This means developers can deploy Solidity-based smart contracts directly on Polkadot without needing to overhaul their existing Ethereum-based applications.

For developers and businesses already invested in Ethereum, this feature represents an unprecedented opportunity to tap into Polkadot’s shared security, native interoperability, and elastic scalability without sacrificing their current infrastructure. By enabling Ethereum dApps to seamlessly port to Polkadot, the network significantly lowers the barrier to entry while ensuring developers can leverage its unique features.

This development also adds intrinsic value to DOT, which could see increased adoption as a universal fee token for these smart contract interactions. Beyond financial transactions, the DOT token will underpin gas payments, staking, governance, and other essential operations.

The Polkadot Virtual Machine (PVM) is Polkadot's version of the Ethereum Virtual Machine (EVM). It allows developers to run Ethereum-compatible smart contracts within the Polkadot ecosystem using tools and languages they already know, like Solidity. The PVM works seamlessly with Polkadot’s network structure, enabling developers to create dApps that benefit from features like scalability, security, and cross-chain interoperability.

Elastic scaling is another highlight of the 2025 roadmap. As blockchain adoption grows, network scalability becomes a critical factor. Polkadot’s elastic scaling mechanism allows the network to dynamically allocate multiple relay chain cores to meet increased demand. This ensures smooth operations without bottlenecks, even during periods of heightened activity.

For Solidity developers, this means applications running on Polkadot will benefit from unparalleled scalability. Whether it’s high-frequency trading, NFT marketplaces, or complex DeFi ecosystems, elastic scaling ensures consistent performance and user experience.

Last November, Polkadot conducted the ultimate stress test (The Spammening) on its sister network Kusama, which mirrors Polkadot's codebase and architecture, and bombarded the system with massive transaction loads to prove it can scale and perform under extreme real-world conditions.

The Kusama network managed to scale and deliver 143k TPS ...and that's just at 23% capacity.

Why this matters: Polkadot’s proven scalability ensures innovation isn’t limited by capacity. High-volume gaming, finance, and data-intensive computing (DePIN) projects can scale here effortlessly.

Builders, this one's for you: If your project dreams big, Polkadot is your infrastructure. Say goodbye to bottlenecks, and hello to your era of pure potential.

Interoperability has always been a cornerstone of Polkadot’s design, but the Unified Address Format takes user experience to a new level. By introducing a single address prefix for the entire ecosystem, Polkadot simplifies transactions across parachains and rollups, reducing errors and making the ecosystem more accessible to non-technical users. This streamlined approach is particularly beneficial for dApps migrating from Ethereum, as it reduces the friction associated with onboarding new users.

The expanded use cases for Solidity smart contracts also enhance DOT’s utility within the ecosystem. The roadmap proposes using DOT as a universal fee token across all chains. This creates a unified economic model, where the same token facilitates governance, staking, gas fees, and cross-chain transactions.

Additionally, features like fast unstaking (as little as two days during low network activity) further increase DOT’s appeal, especially for validators and delegators who require liquidity flexibility.

Credits to @Polkadot and @dotlake_xyz for used images and information.